3 Must-Bookmark Resources (2025 Edition)

Reports on CRE, Private Credit, and Hiring for Startups

Happy Sunday!

In today’s digest, I will share three resources you need to bookmark (all of them are free and linked below):

CRE: 2025 Best Performing Cities Report — it’s simply excellent.

Private Credit Outlook 2025 from With.Intelligence — great data, cohesively organized. I threw in a bonus article, see if you can find it. It’s a good one (albeit a bit less rosy than the rest).

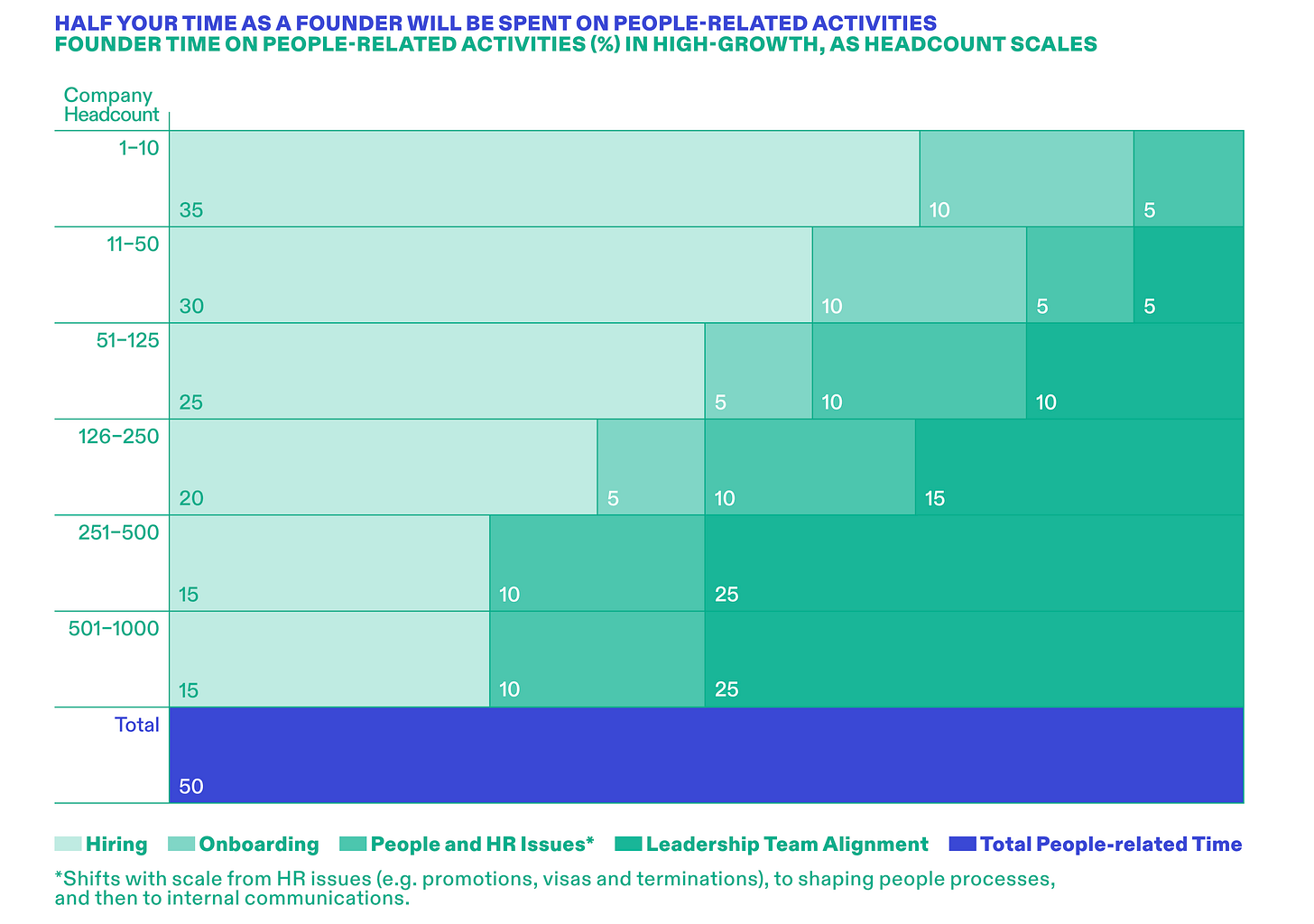

Scaling Through Chaos: Index Ventures studied over 200,000 founder and employee career profiles from 210 of the most successful tech companies. This is their opus magnum on building and leading teams for start ups. Are you a founder? Or investor in venture capital? Read it.

Before we jump in:

Accredited Insight is a unique newsletter: we are the only voice offering a perspective from the LP seat. We cover both the good and the not so good—and often, useful resources, like we are sharing today —drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

Sales pitch over, let’s get going.

2025 Best Performing Cities Report

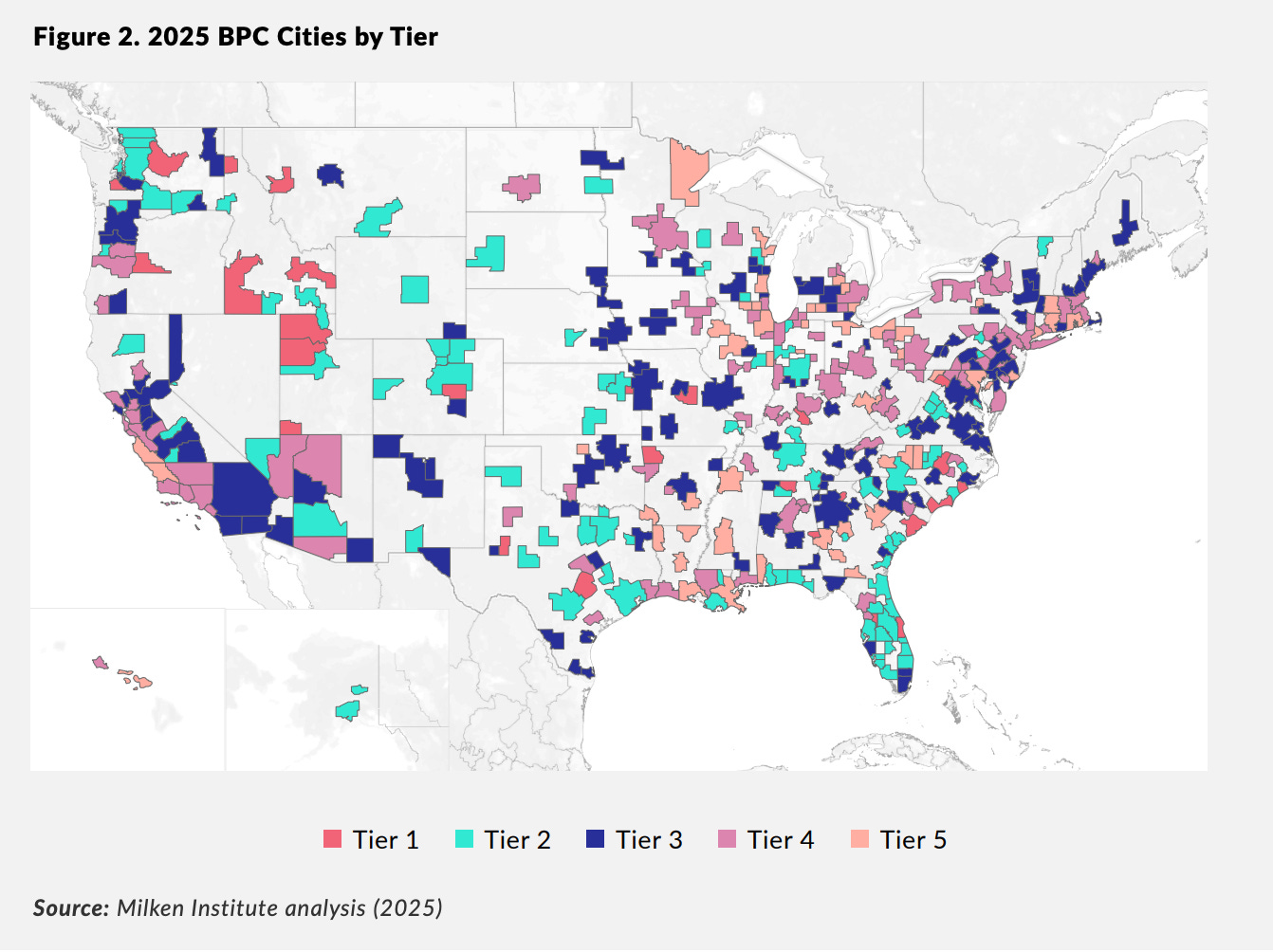

The Milken Institute's 2025 Best-Performing Cities report is an excellent resource for any CRE investor, lots of good data, organized by city. Cleanly presented visuals. Do I need to say more?

The report evaluates the economic performance of 403 U.S. metropolitan areas, focusing on metrics such as job creation, wage growth, high-tech industry impact, housing affordability, and broadband access.

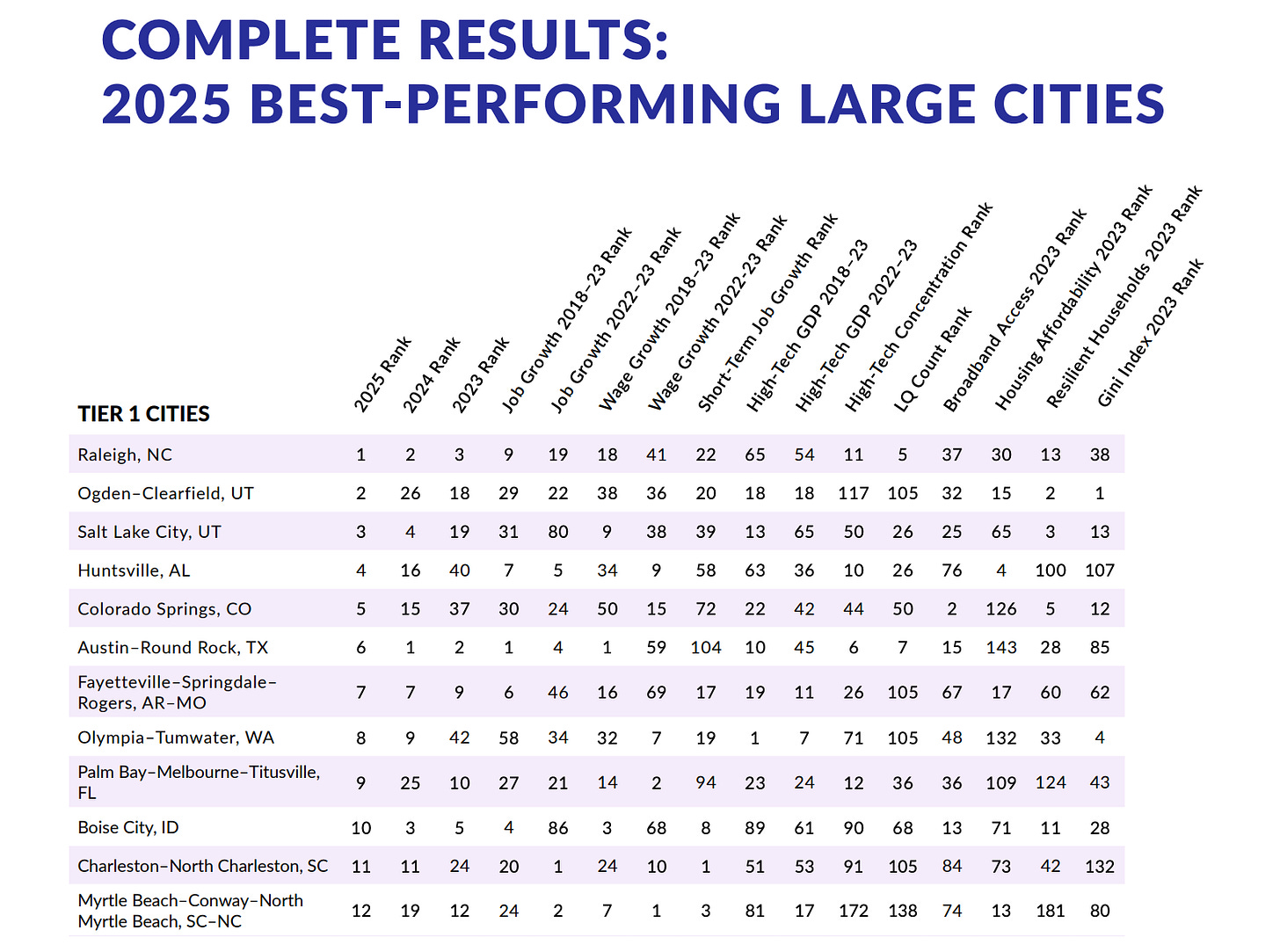

Top Performers:

Large Metros: Raleigh, NC: Why? Robust employment conditions and a thriving high-tech sector. Following Raleigh are Ogden–Clearfield, UT; Salt Lake City, UT; Huntsville, AL; and Colorado Springs, CO.

Small Metros: Gainesville, GA, leads the small metros category.

Notable Trends:

Cities exhibiting strong labor markets, widespread broadband access, and lower income inequality tend to perform better.

Higher wages + affordable living costs are increasingly attractive to younger workers (no surprises here).

Significant Changes:

Tulsa, OK, experienced the most substantial rise, climbing 99 spots to 86th, driven by improved labor market conditions.

Conversely, San Francisco, CA, saw a dramatic decline (this will break some heart), dropping from 27th to 126th, primarily due to downturns in its technology sector and associated challenges.

Private Credit Outlook 2025

Before your eyes glaze over, read this. BONUS CONTENT, you found it. JP Morgan’s COO is ringing bells about the relationship between private credit providers and small businesses.

TL;DR: “There is a lot of direct lending going into the smaller side of middle markets,”[Daniel Pinto] said at the World Economic Forum in Davos. “How these funds are going to behave in a downturn with small businesses is something you want to be concerned about…”

The Private Credit Outlook 2025 report by With Intelligence analyzes the evolving landscape of private credit, the darling of private markets.

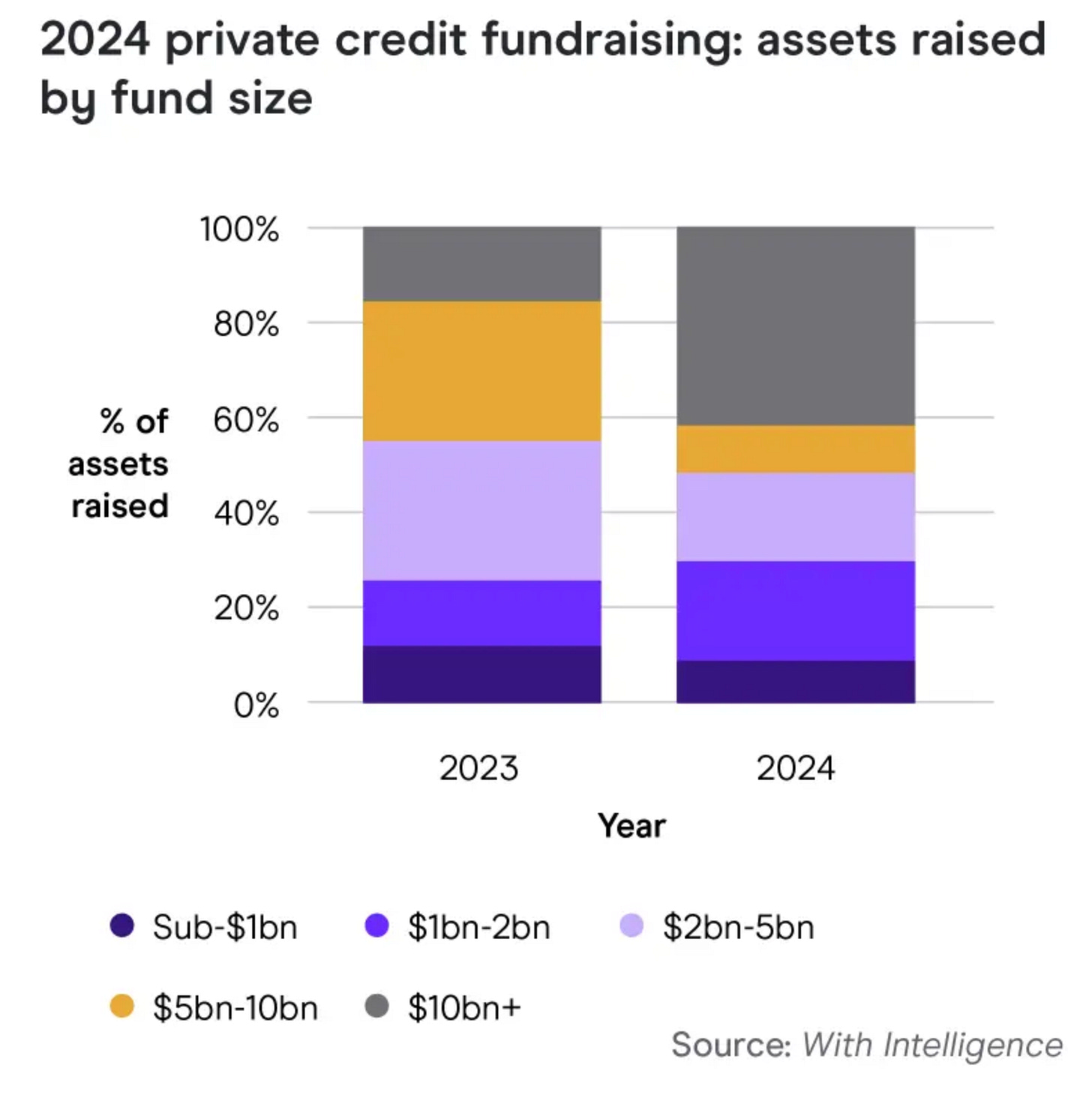

Fundraising Trends:

Private credit fundraising reached $209 billion in 2024, marking a 5% increase from the previous year.

The growth is increasingly concentrated among a few top-tier managers, with five funds accounting for two-thirds of direct lending fundraising in 2024. Check this out:

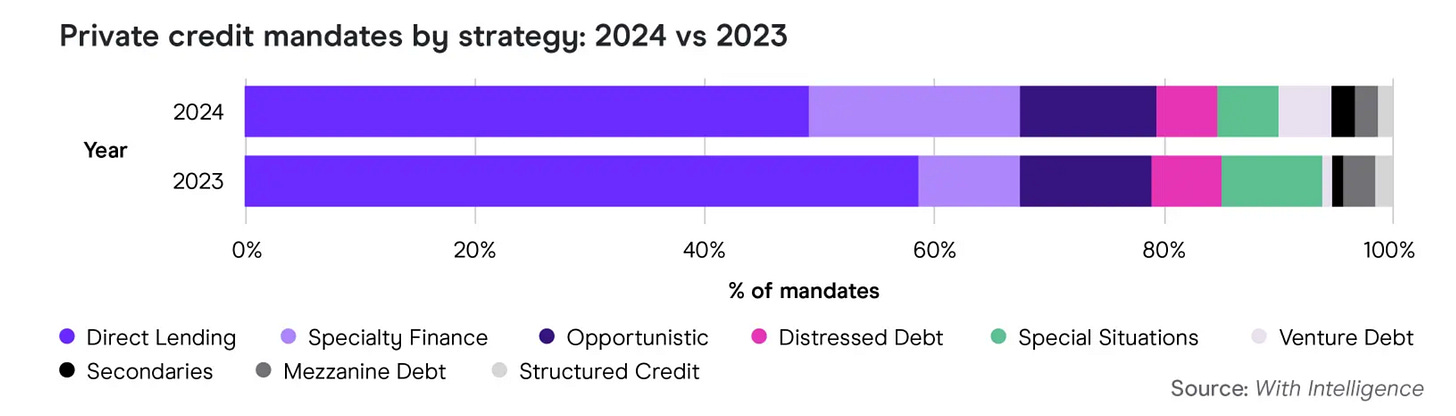

Investor Preferences:

Limited Partners (LPs) are showing interest in direct lending, specialty finance, and opportunistic credit strategies.

Allocations to specialty finance rose from 10% in 2023 to 18% in 2024, with expectations for continued growth in 2025.

Scaling Through Chaos

Index Ventures studied over 200,000 founder and employee career profiles from 210 of the most successful tech companies. Scaling Through Chaos offers data-driven insights, case studies and frameworks for scaling companies.

Great read for someone who’s building a company.

I hope you found these resources useful. Have a wonderful week!