Good morning!

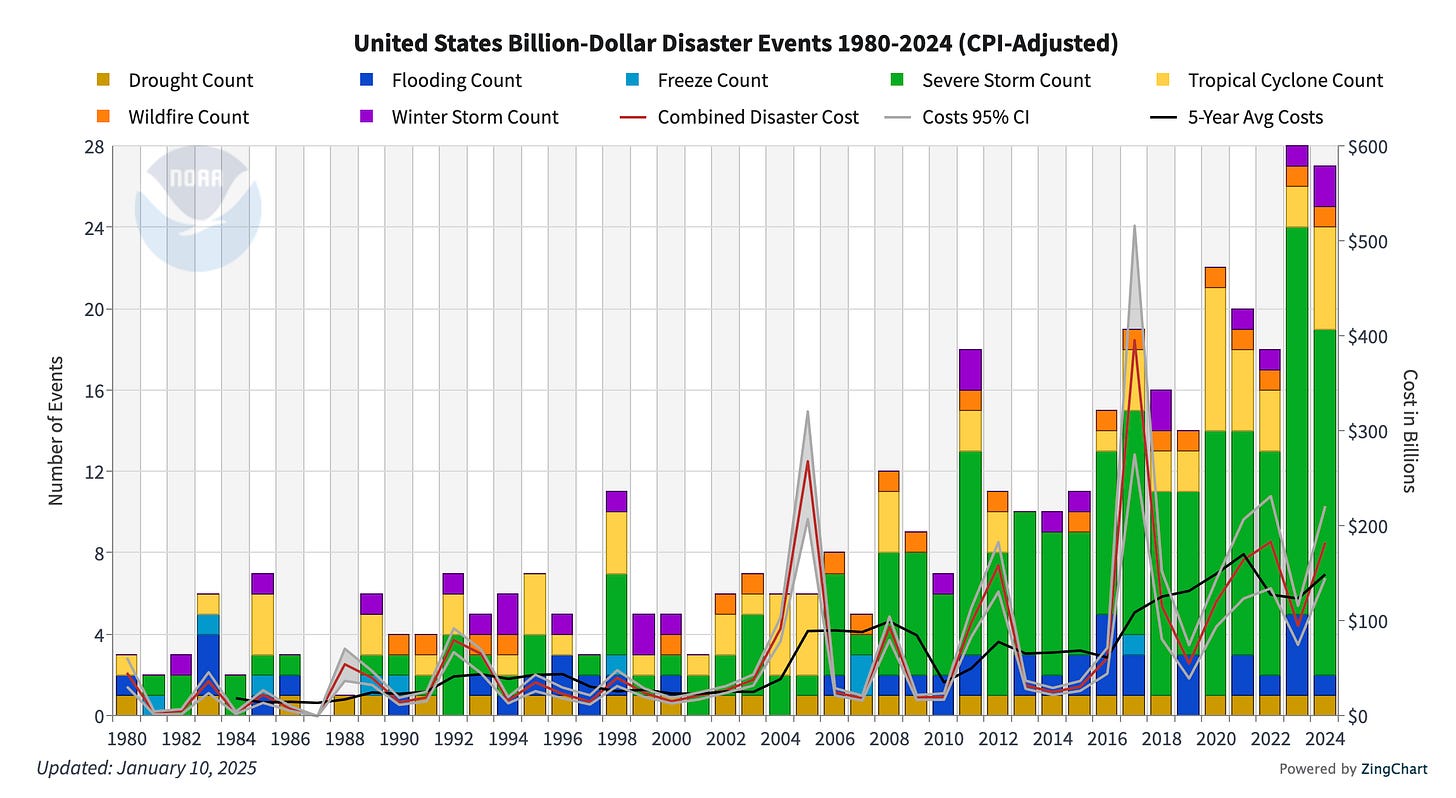

Recent wildfires in Los Angeles have brought forward growing risks faced by property owners in high-risk regions. With natural disasters like wildfires, floods, and hurricanes becoming more frequent and severe, the commercial property insurance market continues to adapt lead to higher costs.

As a limited partner, why do you care about insurance? Because with some property types (multi-family, student housing, and senior living - I’m looking at you!) insurance premiums are one of the major uncontrollable expense items. If you need to understand how it affects deal performance, read this:

And just as the market started showing stabilization after years of volatility, the reprieve was brief: recent events will certainly affect all participants in the quarters ahead. Take a look at the increasing cost of major disaster events:

Today we’ll take a look at two commercial property insurance reports. In addition, we’ll cover an article that discusses property insurance coverage pitfalls for cannabis businesses and landlords.

A Stabilizing Market (No More?)

According to a recent report by USI Insurance Services, buyers with favorable risk profiles may experience rate decreases or minimal increases this year, reflecting a positive shift after years of steep rate hikes. For accounts with poor loss experience, rate increases are expected to moderate to 10%-20% during the first half of 2025, down from the 15%-30% spikes observed in late 2024.

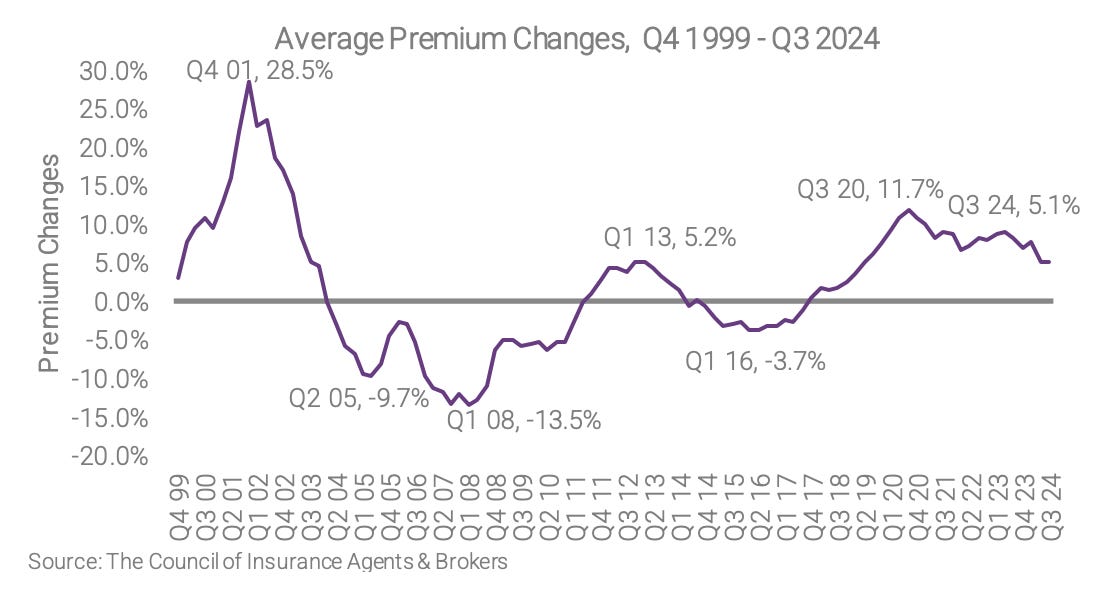

This trend is further supported by data from the Insurance Information Institute (Triple-I), which highlights a decline in commercial property insurance rates from +3.4% in Q1 2024 to -0.94% in Q2 2024. This marked the first rate reduction after 27 consecutive quarters of increases.

The chart below shows trends for property and casualty premium changes:

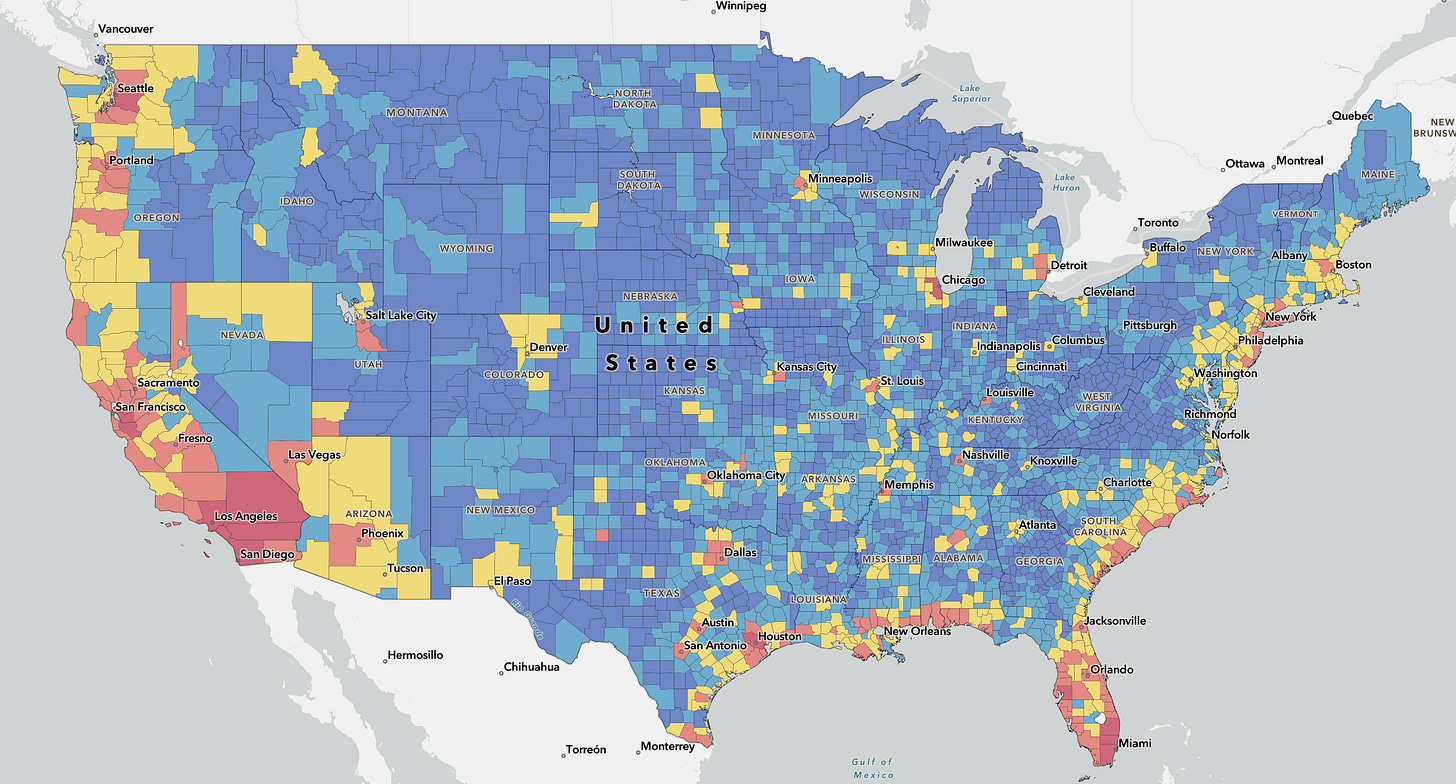

Highest risk areas for natural hazards? No surprises with this National Risk Index Map from FEMA. The map linked below is interactive, you can zoom in on county level to see hazard type risk ratings.

One of the most pressing challenges facing the industry is the undervaluation of commercial properties. Studies indicate that approximately 90% of buildings are underinsured, leaving property owners exposed to significant financial risks in the event of a loss.

Cannabis Insurance

I wanted to highlight this National Law Review article article, as there isn’t much written on insurance considerations specifically for cannabis businesses and property owners.

One key issue is landlord knowledge and liability - as illustrated in the Mosley v. Pacific Specialty Insurance case, landlords may not be liable for tenant cannabis operations if they can prove they were unaware and couldn't have discovered them through ordinary diligence.

The article also warns against misrepresenting business operations on insurance applications, such as claiming to be a retail dispensary when actually conducting manufacturing operations.

Many claims have been denied due to failure to meet specific security safeguard warranties, which often exceed state regulatory requirements. These can include detailed specifications for vault construction, surveillance systems, and storage of cannabis products.

Our Thoughts on the Road Ahead

Unfortunately, the signs of stabilization in insurance markets will likely be short-lived. Secondary perils—such as severe storms and wildfires—remain a significant driver of losses. With wildfires still raging in LA, an event that will likely become the costliest in the US history, it is prudent to expect future rate increases and more restrictive changes in commercial property insurance coverage.