Did you know that the concept of carried interest has nautical ⚓️ roots?

Back in the 16th century, ship captains sailing dangerous trade routes were rewarded with a 20% share of the profits from the goods they transported - quite literally, what they carried. It was a straightforward tradeoff: take on risk, share in the upside.

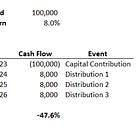

Fast forward to today, and the same term is used in real estate private equity (REPE) to describe the promote (the share of profits sponsors earn after hitting a preferred return). But in modern structures, GPs can start collecting promote long before LPs fully recover their capital, even when they’ve taken on limited downside risk.

The original spirit of shared risk and aligned reward has, in many cases, quietly drifted out to sea (sorry for the pun).

REPE fees are often complex, layered, and poorly understood. Sponsors use a variety of fee types that can materially impact net returns. Most LPs agree sponsors should be paid fairly, but excessive or poorly structured fees can erode performance and signal misalignment.

In this article, we’ll cover:

🔧 Most common fee structures

💰 Typical ranges (aka what’s “market” for asset management, promote, acquisition, and more)

🧐 What LPs should pay attention to (including some red flags)

For a deeper dive on waterfalls, read this:

Most Common Fees

REPE fees can generally be grouped into two categories: ongoing management fees and transaction-based fees.

A third, critical component is the promote structure (or “carried interest”), which governs profit-sharing. We’ll briefly discuss the issues with catch up provisions and tiered waterfalls.

Let’s dive in.