GP Stakes in Real Estate: The Math and The Incentives

How Selling GP Stakes Changes the Economics—and Why It Might Not Be What It Seems

“An incentive is a bullet, a key: an often tiny object with astonishing power to change a situation” - Steven D. Levitt

Incentives matter. A lot.

We’ve written before about how waterfalls and promote structures shape incentives in private placements (here and here), but nowhere is it more obvious than in GP stakes deals in commercial real estate.

This article picks up where last week’s GP stakes primer left off (read that first if you missed it).

Today, I’ll break down:

✅ The mechanics of GP stakes in real estate

✅ How selling stakes influences GP incentives

✅ GP stakes from three perspectives: Deal LP’s, Stakes LP’s, and the GP’s

✅ Key questions LPs should ask before investing in GP stakes funds

GP Stakes in Commercial Real Estate

GP stakes investments involve buying a slice of the GP entity—not the deals themselves, but the firm that runs them.

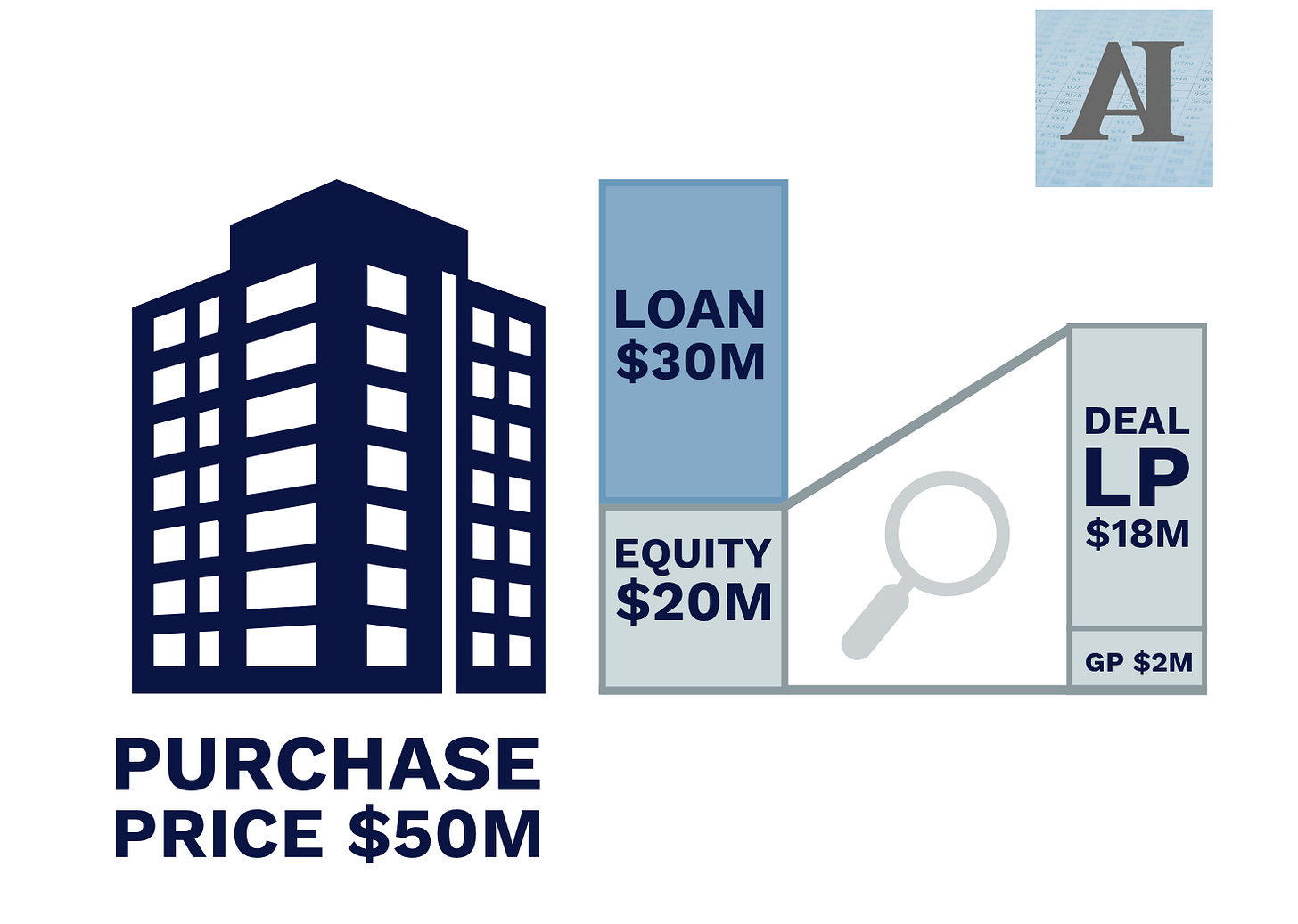

Let’s start with the traditional structure: LPs (limited partners) put up most of the capital—typically 90%—and in return, they get most of the profits (let’s say 80%) after an 8% preferred return.

Waterfall terms can vary wildly, but for today, we’re focused on capital contribution: 90% from LPs, 10% from the GP.

The GP, however, has the option to sell part of that 10% stake, along with a share of their management fees and carried interest (promote).

Compared to private equity or hedge funds, real estate GP stakes deals less common, and here’s why:

Deal-by-deal model: many real estate firms don’t manage perpetual funds with stable fee income. Instead, they raise capital deal by deal or fund by fund, making GP stakes investments less predictable.

Less recurring revenue: unlike private equity firms that earn steady management fees on committed capital, real estate GPs—especially those focused on ground-up development or value-add—rely heavily on promote, which is inconsistent.

Fewer scalable platforms: the most attractive GP stakes deals involve firms with large, scalable platforms. But many real estate GPs are mid-sized or boutique operators that don’t fit that model.

But "less common" doesn’t mean nonexistent, and some of the deals I’ve seen over the years are borderline egregious. Let’s dive in.