GP Stakes Investments: a New(ish) Frontier

A Deep Dive into GP Stakes Investing and Its Benefits for LPs and GPs

Q: What is the common thread between private equity and reliable distributions?

A: Oxymoron

I couldn’t resist. But don’t go just yet, because figures of speech are not the subject of today’s article. Neither is another valid answer — continuation funds (although those wonders of finance certainly deserve their own deep dive).

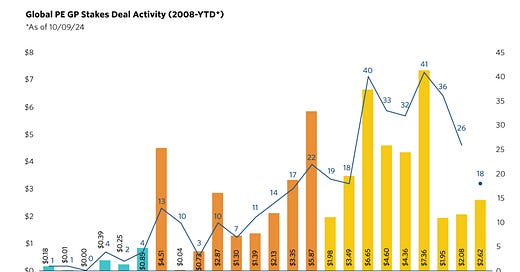

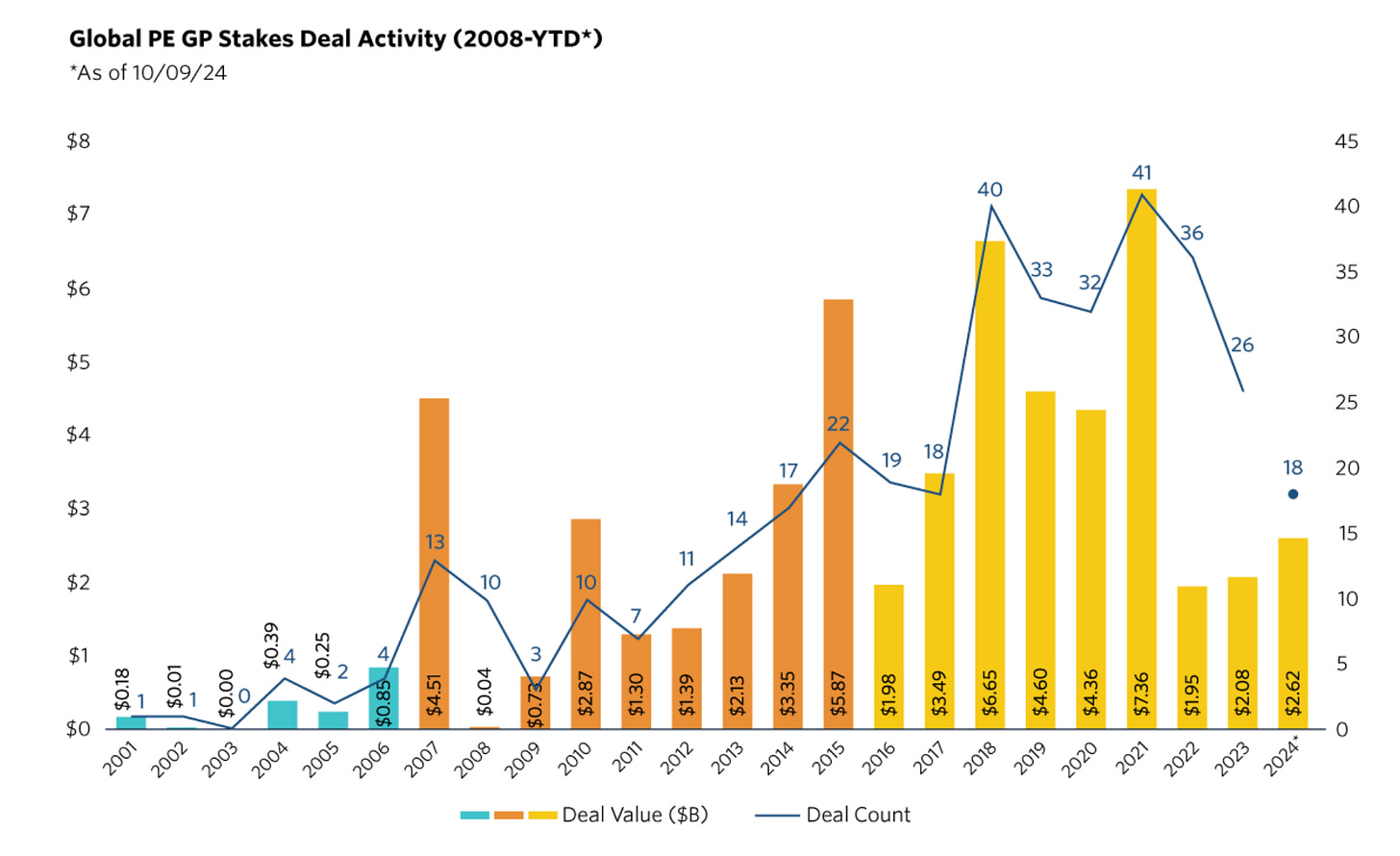

Today, we will talk about GP stakes funds in private equity and CRE. Traditionally the domain of large institutional investors, these funds are now becoming increasingly accessible to high-net-worth individuals. Case in point: last summer, Investcorp partnered with Securitize to offer its latest GP stakes fund to individual investors on a public blockchain - yet another sign of a push by institutional fund managers to reach retail investors.

"When we started this business – what is now Blue Owl GP Strategic Capital but at the time was Dyal Capital Partners – in 2010, investors had very little appetite for the strategy. They had never heard of GP stakes investing and we had to crawl through glass to convince them that this could be an opportunistic investment strategy." - Sean Ward, Blue Owl

Fast forward to today, and the landscape has completely changed. No one is crawling through glass anymore. And since nothing is going to stop this train, your only option is to learn about it!

In this article, I’ll break down:

How GP stakes funds work

Their benefits and risks for investors

Key industry trends and developments

Links to additional resources and white papers

What Are GP Stakes Investments?

GP stakes investments involve acquiring a minority stake in the GP entity of an investment firm. Unlike the traditional LP structure—where LPs contribute the majority of the capital and typically receive around 80% of profits above an 8% hurdle—GP stakes investors gain a share of the firm's management fees and carried interest (AKA promote) alongside the GP.

Let me give you an example: a GP entity raises capital from investors to purchase an asset (whether it’s a portfolio company or a commercial real estate property).

Suppose the GP contributes 10% of the equity for the deal. In return, the GP earns its pro-rata share of income and capital gains, along with additional fees. (The rest of the equity is raised from LPs, who will earn 8% preferred return + 80% over the 8% hurdle.)

From here, things get interesting: