Ground Leases: What Every Investor Needs to Know

Is Real Estate Real When You Don't Own the Land?

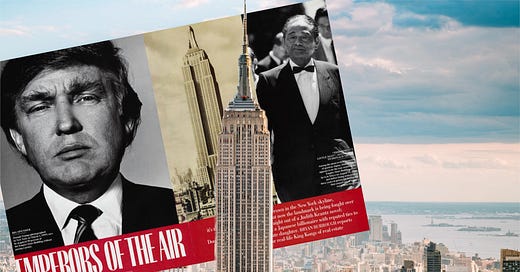

❓What do Trump, New York's most iconic building, and a Japanese businessman with his illegitimate daughter have in common?

A ground lease.

Let me tell you a story about the Empire State Building.

The Empire State Building, the world's tallest at the time, opened in 1931 during the Great Depression, with construction completed in just 13.5 months! Original investors, including John J. Raskob, Alfred E. Smith, and Coleman du Pont, owned it until they sold it in 1961 to investors led by Lawrence Wien and Harry Helmsley for $65M.

As part of the transaction, the new ownership group did two things:

1️⃣ Sold the land to Prudential for $29M and entered into a 114 ground lease (with rent payments going down over time, this is important)

2️⃣ Raised $33 million from over 3,000 shareholders in Empire State Building Associates.

⌛️ In 1991, Prudential put Empire State building’s ground lease on the market.

Prudential hired Salomon Brothers to come up with the valuation on the ground lease. The trouble with it was that the payments were scheduled to go down 📉 until 2076, when the lease expired.

Salomon decided that no rational person would pay more than $25M (or 7.5% yield), but there was a curveball: the investment bankers thought that investors will surely be willing to overpay for this iconic building. So it hit the market with a $39.5M ego-play price tag.

The first bid came at $41M - from Kiiko Nakahara, an illegitimate daughter of a Japanese billionaire and her French husband. At just 4.6% yield, the deal was signed.

Fearing fallout if the building landed in the wrong hands, Prudential pressed Salomon for deeper due diligence on the buyer.

On closing day, it was uncovered—the billionaire backing Nakahara was Hideki Yokoi, a notorious businessman with alleged yakuza ties. The deal was called off at the last minute.

📌 Read Yokoi’s story here - the man is a legend!

Days later, a new buyer emerged: Oliver Grace Jr., a pedigreed, successful investor. He passed the vetting process and closed the deal in Nov '91 for $40M.

It was nearly 2 years later, when Grace's lie came to light. Turns out, Yokoi used Grace as a front to buy the building, and transfer ownership to an entity held by Yokoi 18 months later.

And now we finally get to Trump.

In 1994, Trump's then-wife, Marla Maples, met Kiiko Nakahara at the gym. Kiiko told Marla that her father (who was at that time serving jail time in Japan) gave her the Empire State Building as a birthday present.

Not well versed in NYC real estate, Nakahara turned to Trump for ideas. And Trump, keen on owning the iconic building, came up with the time-honored notion: they'll sue the tenant (an entity controlled by two other storied NYC families) and break the lease ⚖️

The deal was allegedly struck as a 50% stake of any value he could add for $0 in.

To break the land lease, Trump filed lawsuits claiming the Empire State Building Association operated a "high-rise slum" and "second-rate, rodent-infested dungeon." The court battle spanned years but failed to end the lease.

According to NPR, “In the years that followed, Trump waged a war of attrition against Malkin and Helmsley [two controlling families that leased the building], using his fame as a platform to publicly criticize their management of the building.”

💰 2002: Trump and Yokoi sold the land claim to Empire State Building Associates for $57.5M, thus unifying the land and the building for the first time since 1961.

Trump walked away with 50% of the profits, or about $8 million.

Today, you can own part of this history through the publicly traded REIT, $ESRT.

Now that you know how fun ground lease stories can get, let’s talk about what ground leases are.

What’s a Ground Lease?

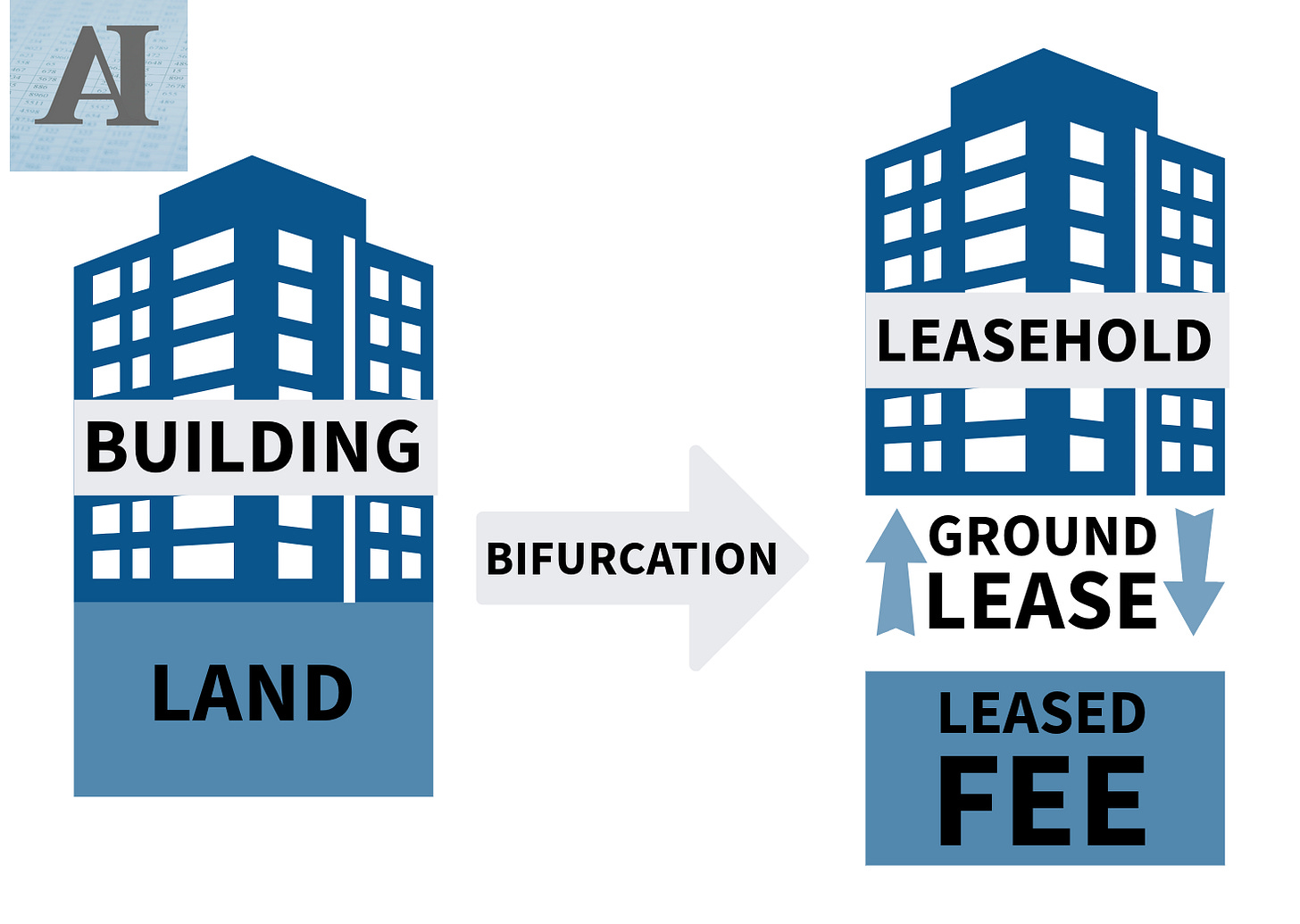

A ground lease is a long-term lease agreement where a tenant (often a developer or operator) leases land from a landlord (usually a government, institution, or private entity) to construct and operate a property.

Unlike a standard lease, where a tenant rents an existing structure, a ground lease tenant typically builds (or operates) on the land at their own expense.

The process of separating the land from the building is called bifurcation. The graphic below illustrates this:

Ground leases are common in major cities where land is scarce and expensive—think Rockefeller Center in New York or LAX airport developments in Los Angeles. But increasingly, we are seeing this structure in hum-drum asset classes in locations not known for scarcity of land (think multifamily in Midwest).

For the history nerds. The concept has historical roots in Roman law, where ground rent (solarium) was an annual payment for land use, and was further developed in Norman England through the Statute of Quia Emptores in 1290, which ended subinfeudation and formalized rent charges.

While ground leases can provide access to prime locations and - sometimes - enhance returns, they come with serious risks that LPs must understand before investing in a deal.

Today, I'll break down:

🔹 Types of ground leases

🔹 Benefits and risks for investors (including the most overlooked one!)

🔹 What you MUST know before investing

🔹 Key terms to understand