[With all due respect] you may be wealthy, but you ain’t CalPERS.

What does a pension fund (or endowment, or family office) have to do with you, retail LP? Everything, if you happen to invest in a deal alongside a joint venture (JV) partner.

Today's case study is a deal where 80% of the equity is provided by a single JV partner, with the remaining portion syndicated to retail LPs. Such deals are not uncommon, and yet very few people understand the implications. We will fix this in next week’s article - don’t miss it.

Accredited Insight is a unique newsletter: we are the only voice offering a perspective from the LP seat. We cover both the good and the not so good—such as potential pitfalls in JV deals—drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

Deal or No Deal?

Please remember, the deal is presented as a case study, and all relevant information has been changed to protect the identity of the sponsor. This is not investment advice.

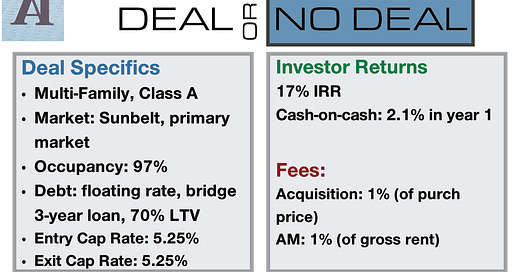

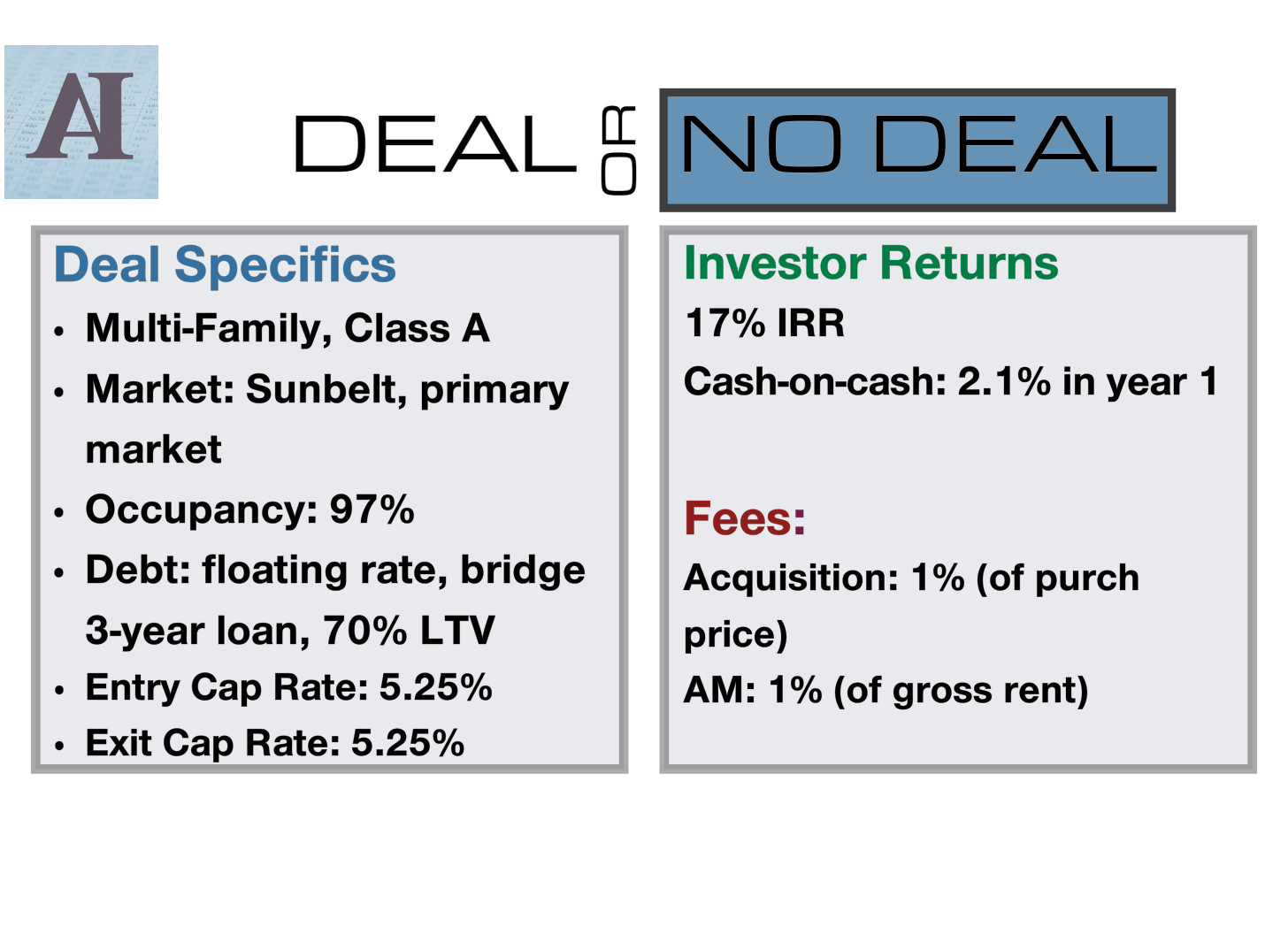

Brief recap of the deal:

This is an acquisition of a Class A multi-family property. The deal capital structure is fairly simple: 70% loan, 30% common equity. Of the common equity, 80% is contributed by a JV partner, the rest is syndicated.

Fees are not unreasonable, and the waterfall is fair (8% pref, 80/20 split).

I won’t bore you to tears with the reasons as to why this deal is a no go. You can read this or this to learn more.

Even without looking at the pro forma, this should be clear:

The only way they can generate a 17% IRR with no value-add or cap rate compression is by rapidly increasing rents;

Rent growth will be the most sensitive input in stress-testing, so the first thing you should do is figure out whether rent assumptions are reasonable.

How to analyze markets and rent assumptions? Read this:

Note the entry cap rate: 5.25%. If you know anything about capital markets, you will know that bridge loans are typically priced at SOFR + spread (typically 2-3%). As of the time of this writing, SOFR stands at 4.39%, so the loan is around 6.9% (4.39%+2.5%). This is often called “negative leverage” (when the cost of debt is higher than unlevered yield). When evaluating deals like this, you MUST pay attention to stabilized yield-on-cost.

Comments on JV Structure

What I *really* want you to think about is the JV structure of the deal. A full write up with perspectives from all parties involved is coming next week. Today, I’ll tell you a story.

In 2020, in the midst of the world falling apart and an absolute freeze in CRE transactions I attended a pitch webinar (buy side) for a multi-family deal. The deal was being sold at a very unfavorable time: the property was in the middle of value-add, all was going according to plan, and the debt was fixed. But the hand of a capable GP was forced by equity partner.

You see, the deal was structured as a joint venture. The equity partner had a 90% stake and critical decision control. This means they could force a sale. The equity partner happened to be a small endowment, with a fickle investment committee. The committee had decided that they had over-exposure to CRE in the Sunbelt. Several deals ended up on the chopping block. This was one of them. The deal was sold at a loss. GP made nothing other than asset management fees during the hold period. The buyer made a killing in two years.

Moral of the story: as an investor (or GP) you must consider the downsides of any given structure. We are starting to see an increased amount of JV deals where a small tranche of equity is being syndicated to retail LPs. As with most things, there isn’t one answer: plenty of advantages to having access to JV capital. Stay tuned for the full discussion!

We hope you learned something from this case study. Please share with your fellow investors if you found this helpful! The full database of our case studies can be found on the front page.