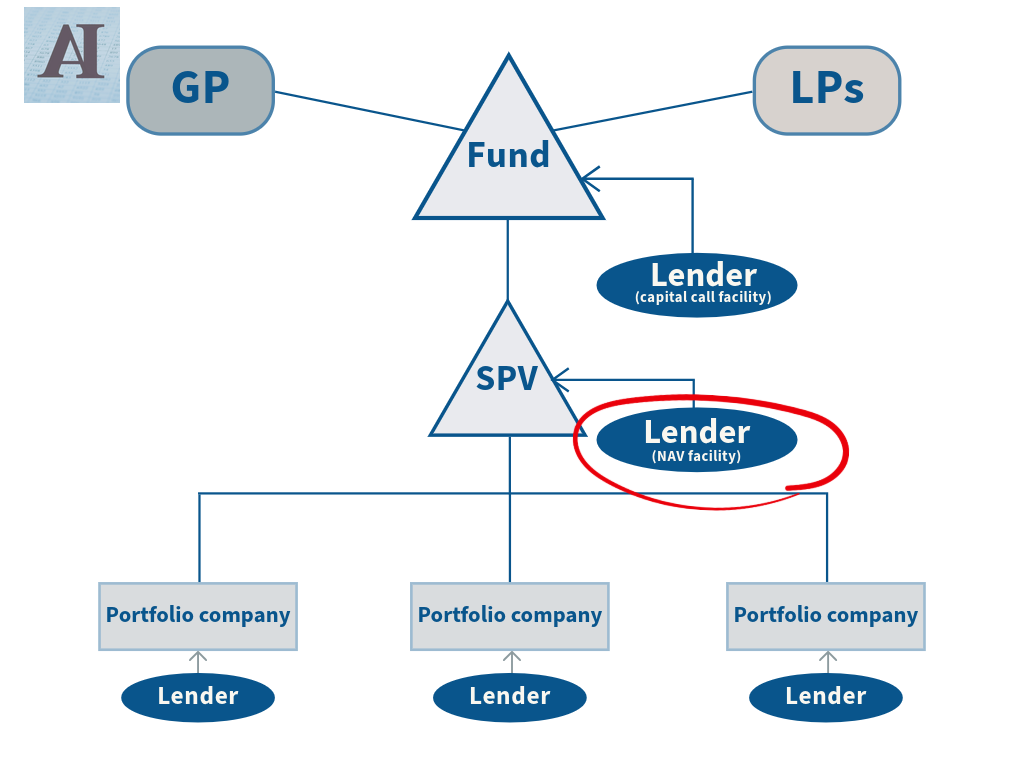

How can a fund manager pay distributions from assets that don’t generate much cash flow and cannot be sold?

By borrowing against the value of those assets, of course.

In today’s article we’ll discuss net asset value (NAV) finance, a strategy that’s been gaining traction with private equity fund managers. I’ll cut to the chase and highlight the downside of such loans (the only upside being access to liquidity). At the end of this article you’ll find a list of resources that go into depth on legal implications and structuring of NAV finance (should you have a bout of insomnia).

Oh, and if you invest in private credit - keep reading. Guess who provides most of these loans?

If you need a refresher, read this:

Let’s jump in!