Ground lease deals have produced some of commercial real estate's most jaw-dropping stories. Before diving into today's case study, let's continue the wild saga behind America's most iconic skyscraper: The Empire State Building. Part 1 can be found here:

How did a Japanese financier with alleged yakuza ties come to own one of America's most famous landmarks? And how did Trump get involved?

[Previously on our show] In 1991, Prudential, the venerable insurance company, decided to sell the ground lease on the Empire State Building. The sale was widely marketed, but the offering wasn’t exactly a golden ticket. The lease was locked in until 2076, with rents that decreased over time.

➡️ Enter Hideki Yokoi, a controversial Japanese tycoon and an absolute legend, if I say so myself. Even Trump was smitten, but we'll get to that later.

5'5", a smart dresser, Yokoi was born into poverty - and became one of Japan's wealthiest people by 1991, when the ground lease sale took place.

Story has it that in 1958, Yokoi was shot in his Ginza office (due to insulting a high-ranking yakuza gangster). With a bullet lodged in his chest, he chased the shooter into the elevator, where he collapsed in a pool of blood. Barely made it to the hospital, where he was cut open in an attempt to retrieve the bullet - which wasn’t found until much later, lodged in his lung.

Yokoi's business antics dominated the headlines as much as his personal life: the guy made a fortune on hostile takeovers of his competitors, had 19 known children (17 of them illegitimate) and into his 70s lived with a 25 year old actress (whose child he fathered).

🏨 On the side, Yokoi was amassing a portfolio of real estate. One of the crown jewels was Hotel New Japan in Tokyo (there is a whole other story of how he came to own it). Unfortunately, in 1982 a fire broke out on the top floor of the hotel, and killed 32 people. Yokoi ended up going to prison for negligence, years later.

By 1987, near the height of the Japanese bubble, Yokoi's net worth worth was around $2 billion (in no small part due to Hotel New Japan, which now stood empty: an undeveloped lot in the center of Tokyo became an extraordinarily expensive piece of real estate), making him one of the wealthiest people in the world.

➡️ That's when another character enters our story. Her name is Kiiko Nakahara, one of Yokoi's illegitimate children - so obscure, even Yokoi's right hand man didn't know about her. Kiiko was married to a Frenchman, Jean-Paul Renoir (chairman of Lehman Brothers Asset Management in Tokyo, no less). And she entered Yokoi's life with a pitch: she offered to buy irreplaceable real estate around the world on his behalf.

Kiiko effectively became a scout for Yokoi, traveling to Europe to tour (and buy) castles. They ended up amassing 15 properties, mostly in France and UK. Yokoi never visited a single one of them.

In the early 90s Yokoi began showing signs of financial distress, following the collapse of the Japanese real estate. The castles were not maintained (and Renoir ended up being sued by the French government for looting some of them, btw). And that’s when Yokoi read in a Japanese newspaper about the sale of the ground lease on the Empire State Building in New York City.

To be continued...

In Part 3 I’ll tell you how the actual sale took place: how Prudential refused to sell to Yokoi due to alleged yakuza connections, yet he still managed to take control of the ground lease… only to have his own daughter pull the rug out from under him.

Now that I have your attention:

Accredited Insight is a unique newsletter: we are the only voice offering a perspective from the LP seat. We cover what we see and what we learned in private markets—drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term:

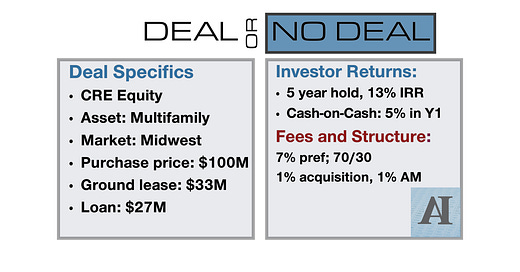

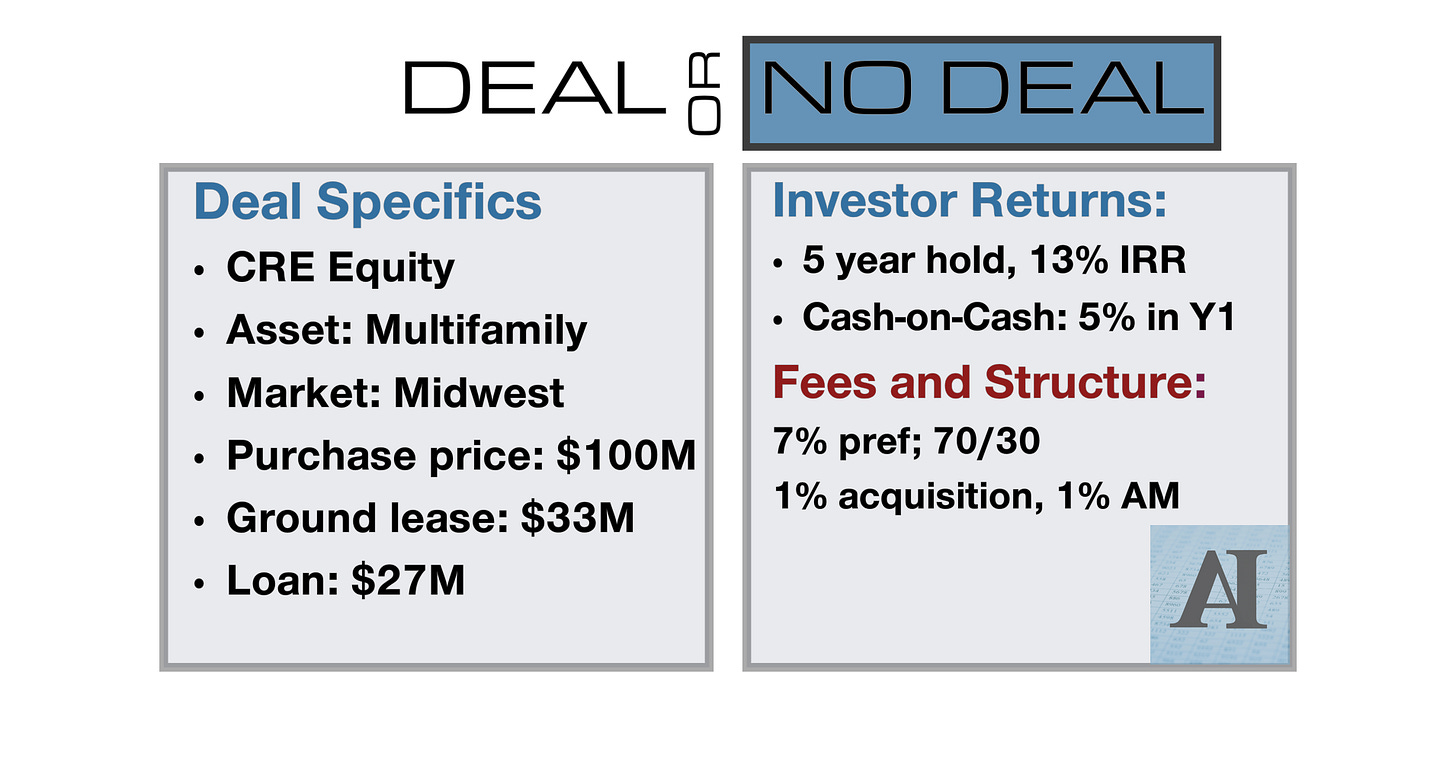

Deal or No Deal?

Please remember, this information is for educational purposes only and should not be considered financial advice. The case study is entirely fictional (but rooted in reality, and based on actual deals we have come across).

Deal summary: equity CRE offering, multifamily. New asset that’s being bifurcated at purchase (you need to read this primer if you don’t know how ground leases are structured).

What’s in it for the sponsor and investors? Glad you asked. A ground lease typically offers a lower interest rate compared to a traditional loan. For instance, if the ground lease carries a 5% rate and the agency debt comes with a 7% rate, the weighted average interest rate would be 5.9%. That’s over 100 basis points lower than taking out a 7% agency loan at 60% LTV.

Today, we will ignore fees, returns, and all other (important) things. I want to draw your attention to the ground lease on this property. Note these two things:

Ground lease balance ($33M)

Loan balance ($27M)

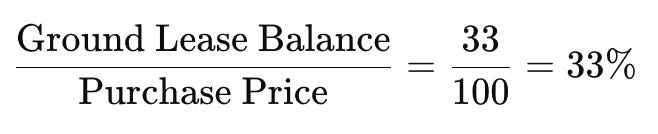

📌 Let’s address the ground lease first

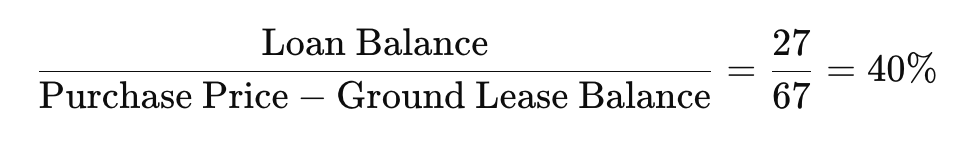

We will calculate the lease detachment point. The math is simple (it’s always a good idea to use total cost, but we are disregarding fees in our example for simplicity).

💡 The lower the detachment point, the wider the margin of safety for the landowner.

❓So what do we do with the loan balance?

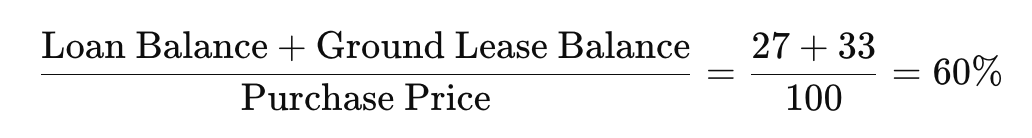

Now, things get interesting. We have two ways to calculate Loan-to-Value (LTV):

1️⃣ Excluding the Ground Lease (LTV on remaining capital):

2️⃣ Including the Ground Lease (LTV on total capitalization):

Which LTV number do you think the deck features? (I’ll tell you later, vote below and no cheating).

👉 Personally, I use Method 2️⃣ (including the ground lease) because, as an investor, all I care about is my position in the capital stack. That’s my margin of safety. In this case, equity sits behind both the landowner and the lender. Read this for more on capital stacks:

For what it’s worth—the deck showed the lower of the two LTVs.

What are your thoughts? Let us know in the comments.

The raw numbers don't look crazy to me, Leyla, though perhaps I am missing something. I much prefer the lower leverage I can access with REITs, but as private equity this does not look crazy to me.

In most of these examples, including this one, I end up frustrated by having no information about the business plan. Is this one a redevelopment project? Or do they think it is undervalued? Or do they think the market is about to move for some reason?