Sunday Digest: Private Markets Insights

The PE Pullback, CRE Macro Themes, and Private Credit Eyes Mortgages

Happy Sunday!

The irony is not lost on me: last Thursday, I published an article that argues that illiquidity premium is all but gone in private markets. My personal stock portfolio is down 9% since then. In contrast, the marks in private markets have not budged over the last few days.

(If you're wondering whether I’m right in the head to invest in public equities despite this volatility, you'll want to read this side of the argument).

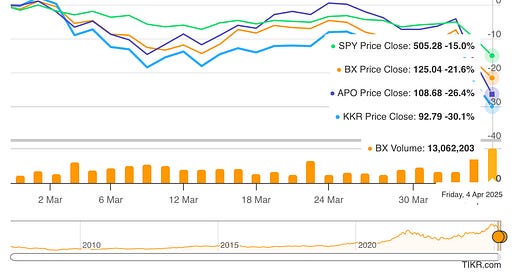

☝️ This image summarizes the past week, so I thought it would be fitting to include an article on PE firms’ public stock performance in today’s digest.

Here’s what we’ll cover:

1️⃣ PE firms are underperforming public markets—by a lot

2️⃣ CRE's near-term outlook: tailwinds and opportunities

3️⃣ Private credit’s latest frontier: your neighbor’s mortgage

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover both the good and the not so good, drawing on countless deals we’ve seen.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

1️⃣ Private Equity Pain

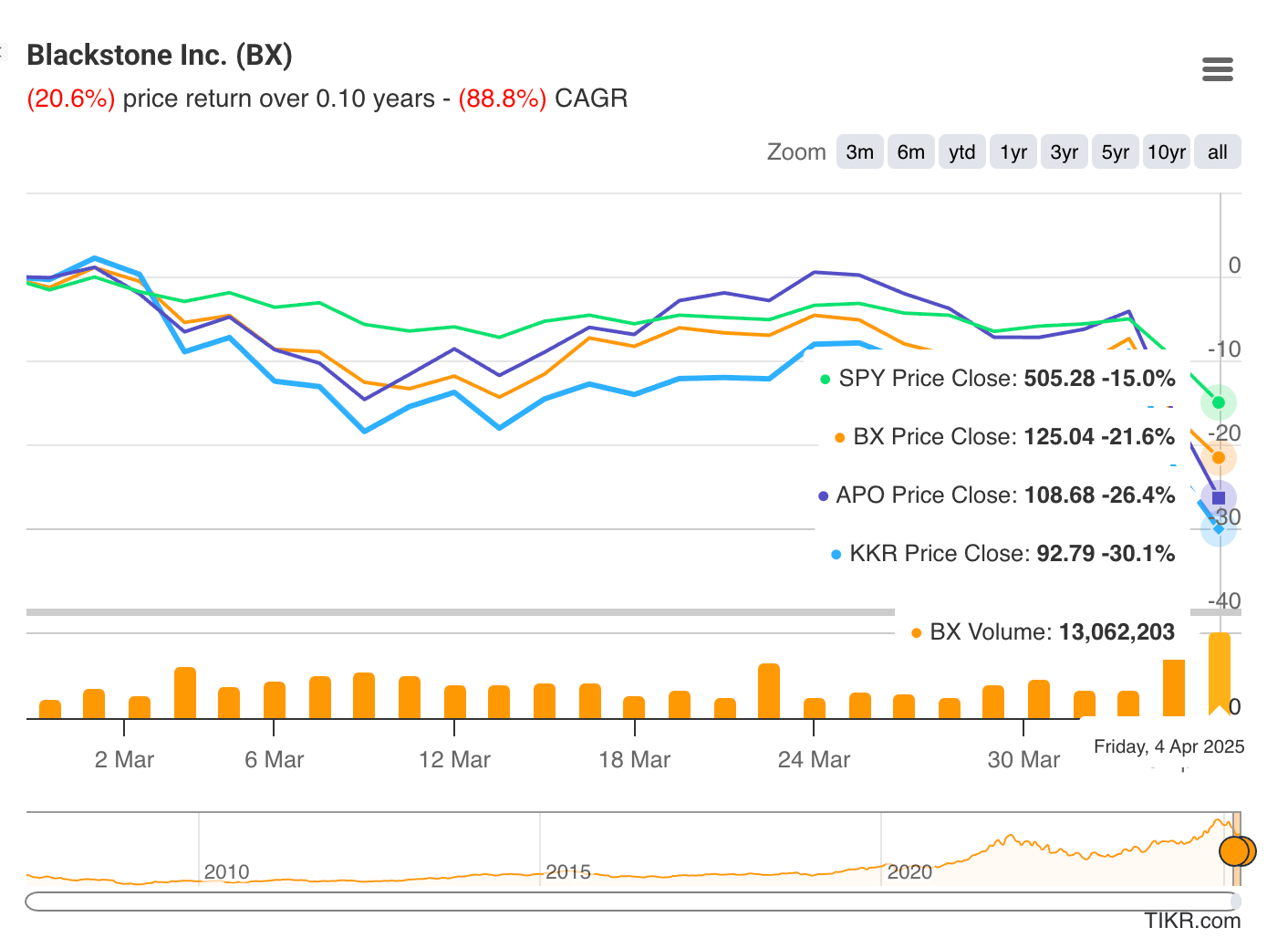

Private equity firms that trade publicly (think Blackstone, Apollo, KKR) are getting hammered, and not just because of broad market turmoil.

According to the Wall Street Journal, these stocks have been sliding harder than the S&P, thanks to rising rates, shrinking exit windows, and investor concern over inflated marks on illiquid assets.

What are markets concerned about?

Declining valuations on portfolio companies

Slowdowns in fundraising and realization

Difficulty returning capital to LPs, impacting IRRs

2️⃣ CRE: Thematic Tailwinds

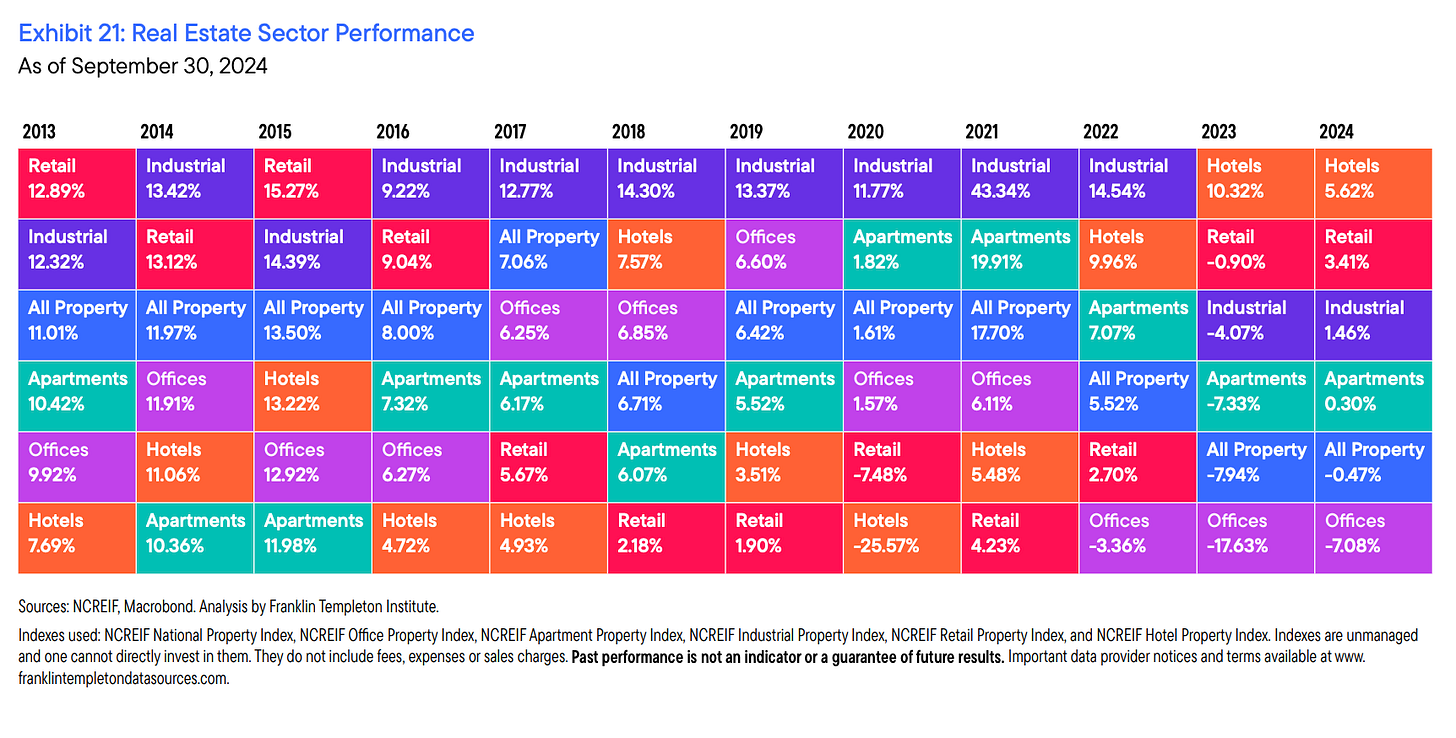

Franklin Templeton’s latest outlook highlights several durable tailwinds shaping real estate: housing affordability, climate resiliency, industrial reshoring, and healthcare demand.

📦 Industrial warehouse continues to benefit from e-commerce and reshoring trends.

Life sciences and medical office properties are poised for growth as aging demographics and innovation drive demand.

🏘️ Multifamily housing remains resilient amid affordability pressures, with Millennials and Gen-Z pushing demand.

Neighborhood retail is seeing renewed interest thanks to spending by younger cohorts.

3️⃣ Private Credit Meets Main Street

Private credit is going from leveraged buyouts to… home mortgages. You heard that right.

According to Bloomberg, private credit managers are expanding aggressively into residential mortgage markets—especially non-traditional and asset-based segments. The logic: traditional lenders are retreating, and there’s yield to be found in complexity.

What to watch:

Regulatory scrutiny is coming

Securitization could follow - here’s how that works:

With that, thank you for reading (and supporting!) If you haven’t yet subscribed, now’s the perfect time: