Tariff chatter is making its way into commercial real estate news. While it’s too early to tell what second- and third- order effects they will cause, the first-order effects are already landing in construction budgets, leasing decisions, and development timelines.

In one word, it can be described as “uncertainty”.

Meanwhile, over in private credit, it’s public market volatility (not policy) that’s triggering a fresh set of challenges.

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover both the good and the not so good, drawing on countless deals we’ve seen.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

🏭 Industrial Real Estate: Tariffs Cloud the Warehouse Boom

According to the latest CommercialEdge National Industrial Report, new tariffs are already causing short-term disruptions in the industrial market:

leasing decisions are being delayed,

construction costs are rising,

some planned projects are heading back to the drawing board.

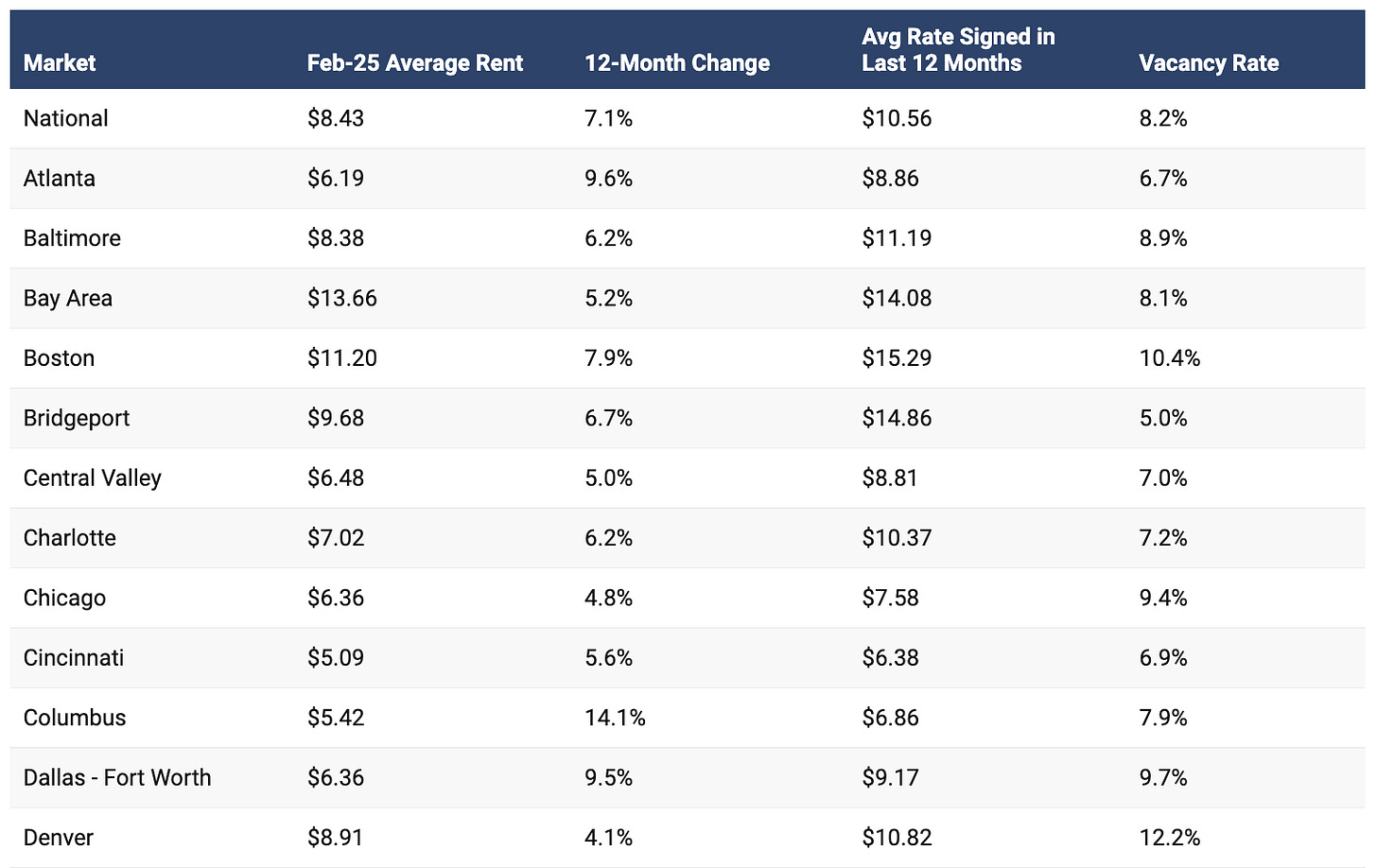

Vacancy rates have increased by 20 basis points MoM to 8.2% (and have doubled in two years), and while rents are still climbing — up 7.1% YoY, the gap between new lease rates and in-place rents is starting to compress.

(Click the link below the image to find data specific to your market.)

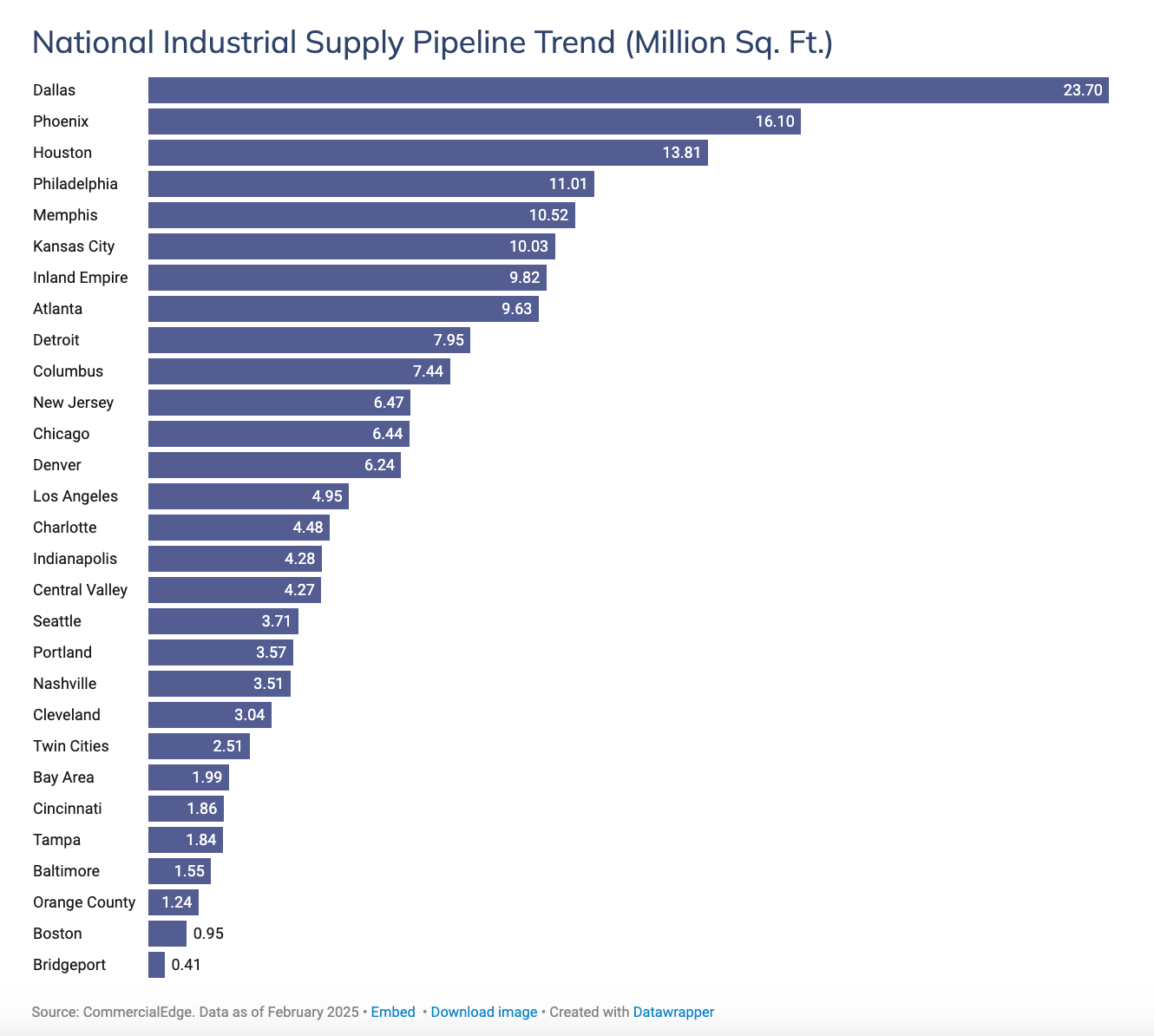

Markets like Dallas, Phoenix, and Houston are still seeing robust development, but even that momentum is at risk if tariffs lead to further inflation in materials and port activity decelerates. Nationwide, construction starts decelerated rapidly during 2024.

Increased material costs from recently imposed tariffs will surely prolong this slowdown, adding pressure to underwriting assumptions and forcing developers to reassess timelines and returns in already-tight markets.

In the near term, expect a holding pattern. In the long term, tariffs might accelerate reshoring, but that’s a wait-and-see game, and one that carries real cost for developers and capital providers alike.

📚 Additional reading: this Houlihan Lokey report provides a summary of how recent tariffs are impacting the U.S. commercial real estate sector. Nothing earth-shattering, but it’s a concise summary.

📉 Private Credit: Liquidity Crunch Spurs Secondary Sales

The private credit market, once a steady home for long-term capital, is now seeing a spike in secondary sales as investors hunt for liquidity amid rising volatility.

According to Reuters, institutions are offloading private credit positions. Not necessarily because the deals are underperforming, but because they need to rebalance portfolios shaken by recent public market declines.

At the core of this trend is the denominator effect: when public market values drop, private investments automatically make up a larger percentage of a portfolio. Since private assets are priced less frequently and often lag real-time conditions, investors can suddenly find themselves over-allocated.

With that, thank you for reading (and supporting!) If you haven’t yet subscribed, now’s the perfect time:

We need one more fact, Leyla, to be able to assess the industrial sector. That is the amount of free rent. In class A office, rents have stayed up more than one would believe. But that is because landlords have been more willing to forego income for a year or so than to lower the nominal rent number. Depending on the length of the lease, that is ballpark a 5% to 10% effective rent discount.

I've seen nothing from industrial about this, that I recall. Have you?