Sunday Digest: Private Markets Insights

Structured Credit Deja Vu, CRE Outlook, Private Credit ETFs

Happy Sunday!

Remember that iconic scene in "The Big Short" where they explain CDOs using a Jenga tower? If you haven't watched the movie yet, I highly recommend it (even better, read Michael Lewis' book first).

Why bring up a movie about the 2008 Financial Crisis? Because collateralized securities—the very things that fueled the crisis—are making a major comeback!

If you don’t have a clue about what I’m talking about, and how the mechanics work, read this:

In today's digest, I'll highlight three things every investor should pay attention to:

1️⃣ The resurgence of structured credit

2️⃣ Commercial real estate outlook for 2025

3️⃣ The SEC's response to private credit ETFs

Before we jump in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective from the LP seat. We cover both the good and the not so good—and often, useful resources, like we are sharing today —drawing on insights from hundreds of deals and numerous conversations with sponsors, LPs, and service providers.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click the button below and chose your preferred term: you can pay $10/month or $100 for a full year.

Sales pitch over, let’s get going.

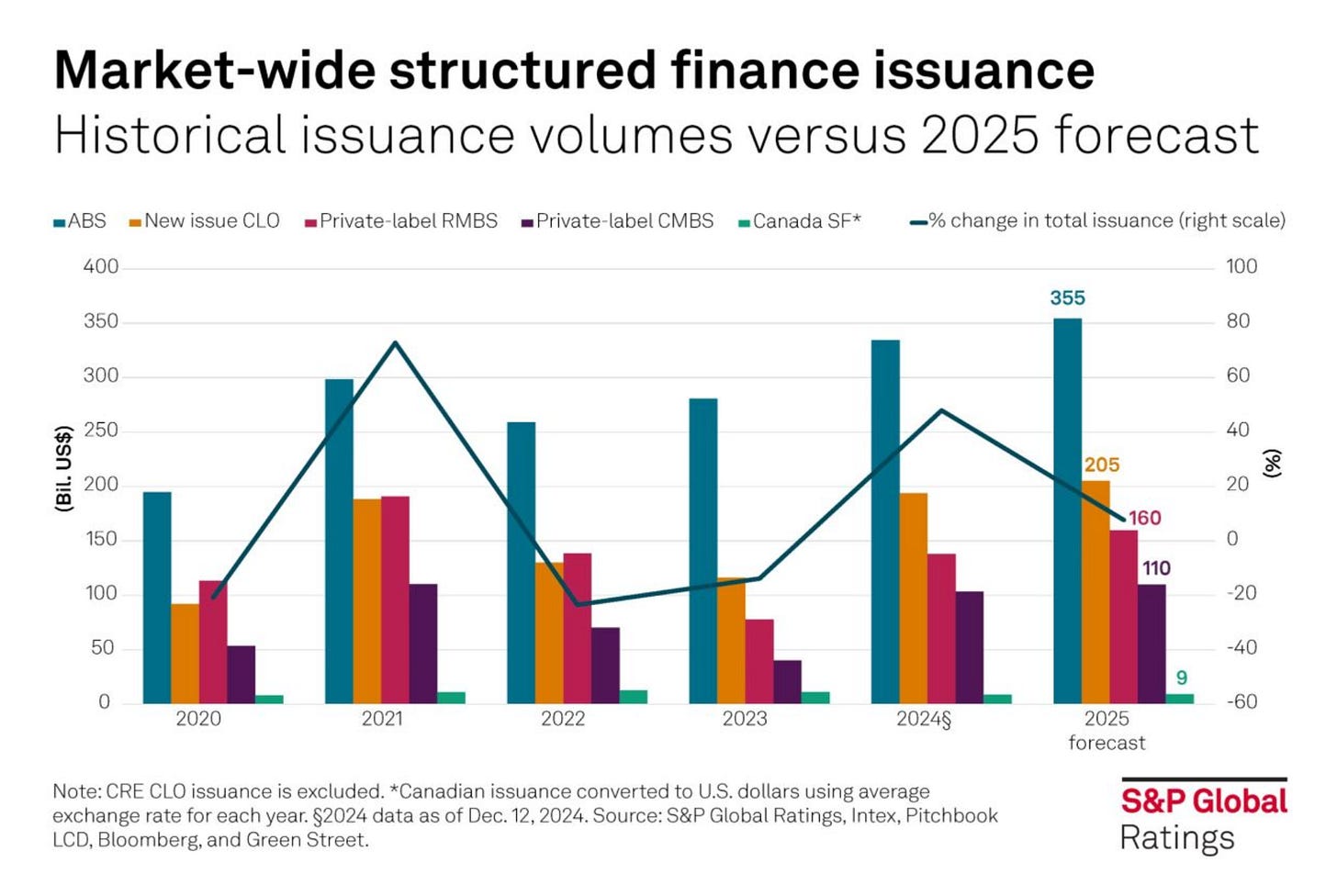

1️⃣ Structured Credit is Back—What Can Possibly Go Wrong?

The very financial instruments that triggered the 2008 crash are experiencing a remarkable resurgence. According to the Wall Street Journal, the SFVegas conference just reached record attendance as demand for structured credit, CLOs, and asset-backed securities soars. Yes, the same conference featured in the book (and the movie). Investment firms such as Apollo and KKR are aggressively securitizing assets ranging from AI infrastructure to data centers.

"Wall Street is once again creating and selling securities backed by everything—the more creative the better—including corporate loans and consumer credit-card debt, lease payments on cars, airplanes and golf carts, and payments to data centers," reports Matt Wirz for WSJ.

🔔 Does this ring any bells: high yields, new asset classes, and a lot of enthusiasm?

2️⃣ Commercial Real Estate

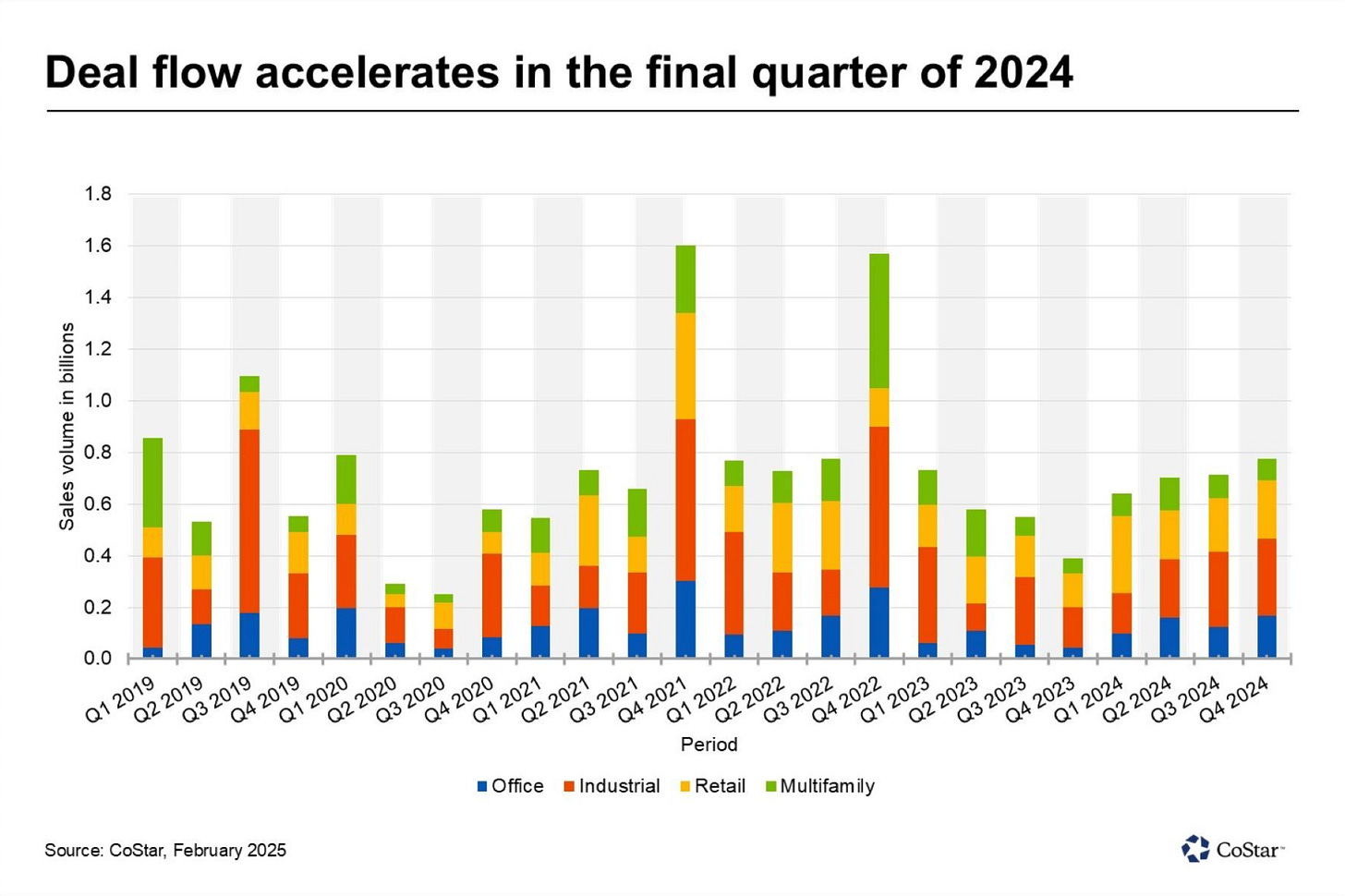

On the real estate front, things are starting to move. According to CoStar, deal flow accelerated across all major asset classes:

Colliers published a 2025 outlook report (here). Some highlights:

🏢 Office

2025 will see the biggest volume rebound, attracting capital amid distress sales (10% of Q3 2024), creating private equity and credit opportunities.

Vacancy will hit 19% by year-end, with weak demand for older buildings and flat net absorption early in the year.

🏭 Industrial

Vacancy peaks mid-2025 as supply-demand stabilizes; rent growth slows to 3-6%.

New construction drops below 300M SF, increasing demand for private credit in refinancing.

🛒 Retail

95.6% occupancy and limited new supply keep retail stable, though rising costs may spur creative financing.

“Elevated construction costs, now 30%–40% above pre-pandemic levels, are limiting new retail developments.”

🏙️ Multifamily

Leads 2025 sales, with assets trading below replacement costs in high-growth markets.

Occupancy recovers by late 2025, rent growth strengthens, but NOI faces pressure from rising costs.

3️⃣ Private Credit ETFs

State Street and Apollo just launched the first-ever private credit ETF (PRIV), aiming to bring private debt into the ETF world. The fund plans to hold up to 35% in illiquid private credit, far exceeding the SEC’s 15% cap, with Apollo stepping in as a liquidity backstop.

Regulators are skeptical—questioning whether one firm can ensure liquidity, pushing back on Apollo’s branding in the fund, and raising questions about valuations. Hours after the ETF began trading, the SEC posted a letter sounding the alarm about these issues (you can read it here).

Despite the concerns, the ETF highlights Wall Street’s growing appetite for “democratizing” private credit. If it succeeds, it could open the floodgates for similar funds.

⚠️ Dear investor, they are coming for YOUR money. Be prepared:

With that, thank you for reading (and supporting!). If you haven’t yet subscribed, now’s the perfect time:

Thanks, Leyla. All of the asset classes Wirz cites are standard components of asset backed securities. Oaktree for example has been investing in all that for years. What I keep trying and failing to determine is whether we have actually had a qualitative change in systemic risk, as seems to have happened with Credit Default Swaps before the Financial Crisis.