There is really only one thing you should be stressed out about when evaluating a real estate private equity deal: losing your money.

In 2021, half of you might’ve read my opening sentence, laughed, and thought I’d lost my marbles. Today, virtually every one of you can think of equity wipeout scenarios.

So the question becomes: how do you spot risk of any given deal before you wire the money?

One of the most useful tools (albeit often overlooked) is the stress test. Not to be confused with a sensitivity analysis (which tweaks one variable at a time), a stress test pushes multiple assumptions at once to see what breaks.

In this article, we’ll walk through:

The fundamentals of stress testing

Which assumptions to pressure-test (and how)

Takeaways for LPs reviewing sponsor models.

How NOT to do a Sensitivity Analysis

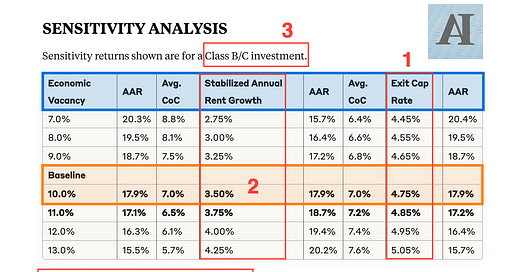

Let’s start with an example of a truly useless sensitivity analysis.

Let’s ignore the ridiculous baseline assumptions for a second and discuss what’s in front of us:

Exit cap rate range: 50 basis points, in 5-point increments.

This should be criminal. Those are rounding errors.Stabilized rent growth? Set at 3.5%?

On a 100+ unit deal, this single number matters a lot, more than a $1M miss on capex. Why? Because it compounds. And outside of a few high-growth pockets, there are very few U.S. markets where rent growth has averaged 3.5% over any meaningful stretch. Most sit somewhere between 1.5% and 3%.

That tiny difference can make or break your IRR.If you see “Class B,” “Premium,” “Platinum,” what have you, your FIRST question should be: Is this sleeve of equity subordinated to another class?

Because if it is, that “sensitivity” you're looking at might be totally irrelevant. You have bigger things to worry about:2% operating expenses growth.

There isn’t a deal out there (outside of NNN leases) where expenses have only grown 2% annually over the last 4–5 years. That number is a fantasy in a land where LPs always make 38% IRR, GPs work for free, and teenagers don’t talk back. (And by the way, this number also compounds).

So now that we’ve walked through what not to do, let’s talk about how to do it right.